While we sleep, they get busy.

Bubble Watching in California

It was a lovely, warm, fogless day in spring in the sleepy, little coastal town in southern California where we live. The night before, we had finally agreed that buying real estate in this bankrupt state is a mug’s game. The decision came in the wake of 18 months of searching for something, anything available. Again and again we would see an ad but by the time we were able to look at the property together, it was already under agreement. Since late last summer, there have been few houses on the market at all. The rumor around town is that the baby boomers from LA have been cashing out their businesses and bringing the bucks to our town to snatch up “bargains,” coastal properties under $2 million. That could be little more than a quaint notion according to the San Jose Mercury News, Bay Area's average homebuyers shut out by cash offers, investors—that’s cash coming from overseas. (Gee, we wonder where they get it…) This explanation seems more credible. Rumor also has it that the banks are going to cough up their REOs any day now, but the number of listings is down about 75% year over year, and holding steady.

We were mostly relieved about our decision. Instead of spending the weekend dragging ourselves around town to inspect overpriced shacks, and being amazed at the shameless gall of the owners to ask such ridiculous prices, we had our feet up reading a good book and were anticipating more of the same for the next two days, when, suddenly, our revelry was shattered by a call from our friend, Jeff.

“There’s a house right around the corner from you. If you don’t buy it, I will,” he said, excitedly.

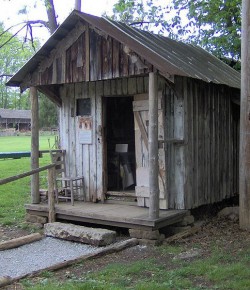

“Do you mean that closet?” we replied. “The one where you have to go outside to turn around? Forget it, we’re not paying $500 a square foot to have our noses pushed up against the front window all day.”

“No, not that one, there’s one up the hill. Only $320k and it’s much better than mine. You’ve gotta go look at it.”

We agreed to look, but not on the weekend. We had too much lazin’ to do.

We called the realtor on Monday morning asking about Jeff’s house up the hill. He couldn’t find the listing anywhere and said he’d call back.

“But while we’re on the phone,” he continued, “what about the house over by the beach? It’s been on the market at least a year. I think the listing expired Saturday. Just what you’re looking for, 3/2, in good condition. The asking price is $379.”

After telling him we’d think about it and talk to him later, and not being able to find the listing online, we drove over to the house. There was a for sale sign with sales flyers out front. The sheet said the asking price was $389,000. The house was ok, nothing special. It’s not the best neighborhood in town, if you can even call it a neighborhood. It’s a hodgepodge of tumble downs and palatials all right on top of each other. Half or more are second homes and empty most of the year. They’re close to the water and therefore surely maintenance nightmares, although, like everyone else, we do love a morning walk on the beach enough to contemplate ownership there.

Back home, we sent the realtor an email asking him to sound out the listing agent about a lower offer. Within the hour he replied. Turns out that the listing had expired on Saturday to be renewed Sunday at the higher asking price, at which time three, count ‘em three, full price offers came in. Oh, and by the way, the little house up the hill? Sold the first morning they hung the sign.

Within six months, although it seems overnight, prices in our sleepy town have jumped from about $250/square foot to a minimum of $350/square foot. Almost nothing, except the rankest of tear-downs, is on the market for more than several days. Last summer for one fleeting moment, it looked like sanity in its housing manifestation of positive cash flow might be within reach. Looks are deceiving, however, when serial Keynesian bubble blowers are in charge and their friends have money to be laundered.

And you, Best Beloved, thought the housing bubble couldn’t be re-inflated.

April 9, 2013

Tags:

Quotable

"One believes things because one has been conditioned to believe them." Aldous Huxley, Brave New World